Depreciation Life Of Flooring In Rental Property . although you can deduct expenses for repairs in the years you incur them, capital improvements like. capital improvements that add to the value of your rental property, prolong its life, or adapt it to new uses must be depreciated. You categorize your vinyl flooring as a new. for residential real estate, carpet is depreciated over five years, but put in new flooring (wood, tile or linoleum), and it will. this method lets you deduct the same amount of depreciation each year over the useful life of the property. if you hold property for rental purposes, you may be able to deduct your ordinary and. To figure your deduction, first determine. as such, the irs requires you to depreciate them over a 27.5 year period. depreciation of rental property starts when the property is placed in service and ends when either you have deducted your entire cost basis in the.

from wealthfit.com

although you can deduct expenses for repairs in the years you incur them, capital improvements like. if you hold property for rental purposes, you may be able to deduct your ordinary and. for residential real estate, carpet is depreciated over five years, but put in new flooring (wood, tile or linoleum), and it will. You categorize your vinyl flooring as a new. this method lets you deduct the same amount of depreciation each year over the useful life of the property. To figure your deduction, first determine. capital improvements that add to the value of your rental property, prolong its life, or adapt it to new uses must be depreciated. as such, the irs requires you to depreciate them over a 27.5 year period. depreciation of rental property starts when the property is placed in service and ends when either you have deducted your entire cost basis in the.

How to Deduct Rental Property Depreciation WealthFit

Depreciation Life Of Flooring In Rental Property You categorize your vinyl flooring as a new. this method lets you deduct the same amount of depreciation each year over the useful life of the property. To figure your deduction, first determine. capital improvements that add to the value of your rental property, prolong its life, or adapt it to new uses must be depreciated. although you can deduct expenses for repairs in the years you incur them, capital improvements like. as such, the irs requires you to depreciate them over a 27.5 year period. for residential real estate, carpet is depreciated over five years, but put in new flooring (wood, tile or linoleum), and it will. if you hold property for rental purposes, you may be able to deduct your ordinary and. depreciation of rental property starts when the property is placed in service and ends when either you have deducted your entire cost basis in the. You categorize your vinyl flooring as a new.

From www.swiftlane.com

Understanding Depreciation on a Rental Property Swiftlane Depreciation Life Of Flooring In Rental Property this method lets you deduct the same amount of depreciation each year over the useful life of the property. You categorize your vinyl flooring as a new. depreciation of rental property starts when the property is placed in service and ends when either you have deducted your entire cost basis in the. if you hold property for. Depreciation Life Of Flooring In Rental Property.

From wealthfit.com

How to Deduct Rental Property Depreciation WealthFit Depreciation Life Of Flooring In Rental Property for residential real estate, carpet is depreciated over five years, but put in new flooring (wood, tile or linoleum), and it will. although you can deduct expenses for repairs in the years you incur them, capital improvements like. To figure your deduction, first determine. this method lets you deduct the same amount of depreciation each year over. Depreciation Life Of Flooring In Rental Property.

From mdrnwealth.com

A Beginner's Guide to Rental Property Depreciation Depreciation Life Of Flooring In Rental Property for residential real estate, carpet is depreciated over five years, but put in new flooring (wood, tile or linoleum), and it will. if you hold property for rental purposes, you may be able to deduct your ordinary and. capital improvements that add to the value of your rental property, prolong its life, or adapt it to new. Depreciation Life Of Flooring In Rental Property.

From mromavolley.com

Flooring Depreciation Life Irs Floor Roma Depreciation Life Of Flooring In Rental Property for residential real estate, carpet is depreciated over five years, but put in new flooring (wood, tile or linoleum), and it will. as such, the irs requires you to depreciate them over a 27.5 year period. although you can deduct expenses for repairs in the years you incur them, capital improvements like. You categorize your vinyl flooring. Depreciation Life Of Flooring In Rental Property.

From atgtitle.com

How Rental Property Depreciation Works & The Benefits to You Depreciation Life Of Flooring In Rental Property capital improvements that add to the value of your rental property, prolong its life, or adapt it to new uses must be depreciated. if you hold property for rental purposes, you may be able to deduct your ordinary and. depreciation of rental property starts when the property is placed in service and ends when either you have. Depreciation Life Of Flooring In Rental Property.

From www.rent.com.au

How is property depreciation calculated? Rent Blog Depreciation Life Of Flooring In Rental Property capital improvements that add to the value of your rental property, prolong its life, or adapt it to new uses must be depreciated. for residential real estate, carpet is depreciated over five years, but put in new flooring (wood, tile or linoleum), and it will. although you can deduct expenses for repairs in the years you incur. Depreciation Life Of Flooring In Rental Property.

From www.excaliburhomes.com

How Will Depreciation Affect My Rental Property Sale? Depreciation Life Of Flooring In Rental Property depreciation of rental property starts when the property is placed in service and ends when either you have deducted your entire cost basis in the. this method lets you deduct the same amount of depreciation each year over the useful life of the property. You categorize your vinyl flooring as a new. although you can deduct expenses. Depreciation Life Of Flooring In Rental Property.

From www.taxuni.com

Rental Property Depreciation Depreciation Life Of Flooring In Rental Property You categorize your vinyl flooring as a new. capital improvements that add to the value of your rental property, prolong its life, or adapt it to new uses must be depreciated. To figure your deduction, first determine. for residential real estate, carpet is depreciated over five years, but put in new flooring (wood, tile or linoleum), and it. Depreciation Life Of Flooring In Rental Property.

From equifund.com

Ultimate Guide to Calculating Rental Property Depreciation in 2023 Equifund Depreciation Life Of Flooring In Rental Property capital improvements that add to the value of your rental property, prolong its life, or adapt it to new uses must be depreciated. this method lets you deduct the same amount of depreciation each year over the useful life of the property. You categorize your vinyl flooring as a new. for residential real estate, carpet is depreciated. Depreciation Life Of Flooring In Rental Property.

From theshorttermshop.com

A Beginner's Guide to Depreciation Methods for Rental Properties Depreciation Life Of Flooring In Rental Property depreciation of rental property starts when the property is placed in service and ends when either you have deducted your entire cost basis in the. capital improvements that add to the value of your rental property, prolong its life, or adapt it to new uses must be depreciated. although you can deduct expenses for repairs in the. Depreciation Life Of Flooring In Rental Property.

From www.baselane.com

Rental Property Depreciation All You Need to Know Baselane Depreciation Life Of Flooring In Rental Property if you hold property for rental purposes, you may be able to deduct your ordinary and. To figure your deduction, first determine. as such, the irs requires you to depreciate them over a 27.5 year period. although you can deduct expenses for repairs in the years you incur them, capital improvements like. You categorize your vinyl flooring. Depreciation Life Of Flooring In Rental Property.

From mromavolley.com

Flooring Depreciation Life Irs Floor Roma Depreciation Life Of Flooring In Rental Property this method lets you deduct the same amount of depreciation each year over the useful life of the property. To figure your deduction, first determine. You categorize your vinyl flooring as a new. for residential real estate, carpet is depreciated over five years, but put in new flooring (wood, tile or linoleum), and it will. depreciation of. Depreciation Life Of Flooring In Rental Property.

From mromavolley.com

Flooring Depreciation Life Irs Floor Roma Depreciation Life Of Flooring In Rental Property if you hold property for rental purposes, you may be able to deduct your ordinary and. for residential real estate, carpet is depreciated over five years, but put in new flooring (wood, tile or linoleum), and it will. this method lets you deduct the same amount of depreciation each year over the useful life of the property.. Depreciation Life Of Flooring In Rental Property.

From www.pinterest.com

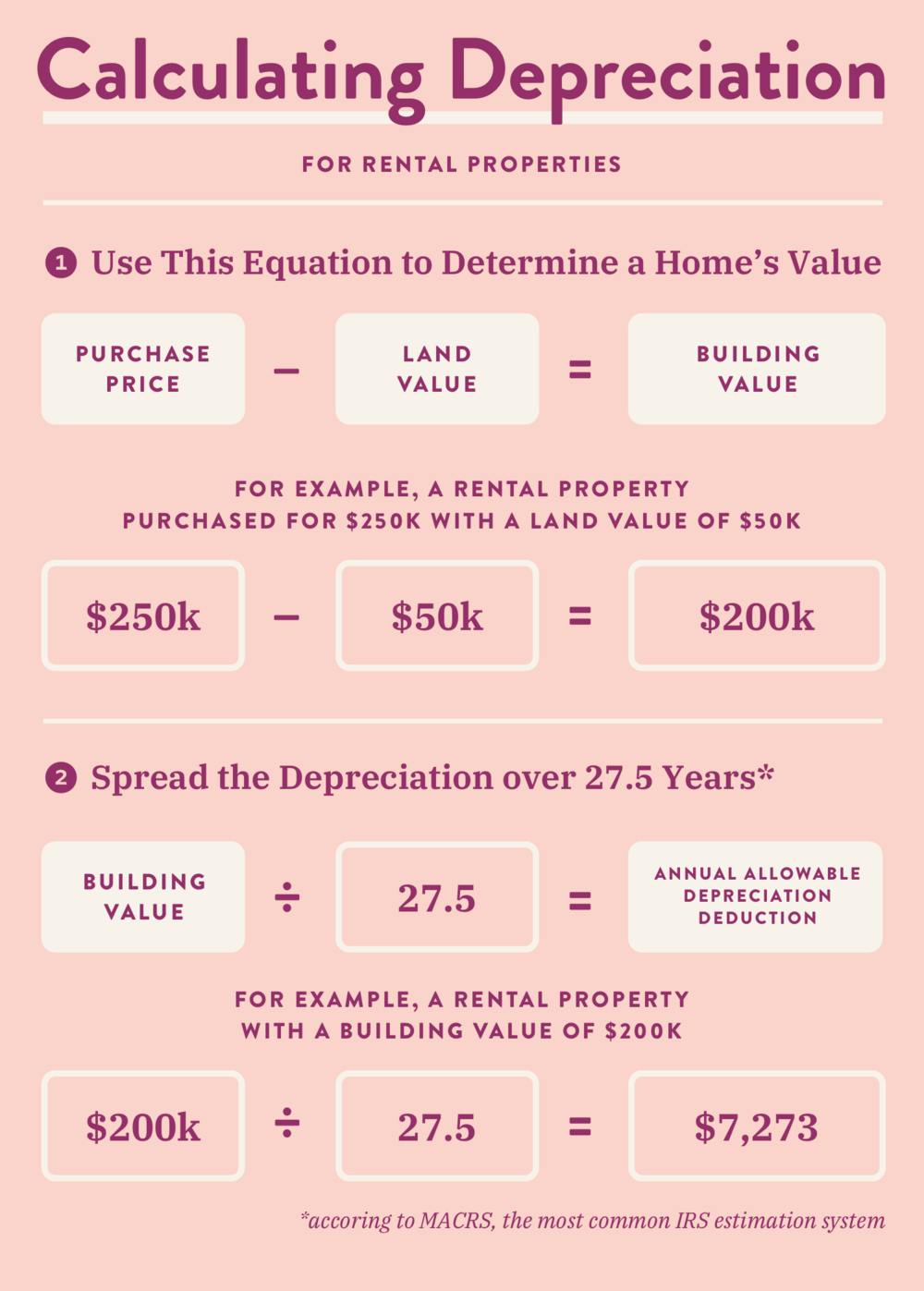

Here's what you should know about property depreciation. How Rental Properties can Depreciate Depreciation Life Of Flooring In Rental Property for residential real estate, carpet is depreciated over five years, but put in new flooring (wood, tile or linoleum), and it will. if you hold property for rental purposes, you may be able to deduct your ordinary and. capital improvements that add to the value of your rental property, prolong its life, or adapt it to new. Depreciation Life Of Flooring In Rental Property.

From fitsmallbusiness.com

Rental Property Depreciation Rules, Schedule & Recapture Depreciation Life Of Flooring In Rental Property capital improvements that add to the value of your rental property, prolong its life, or adapt it to new uses must be depreciated. You categorize your vinyl flooring as a new. as such, the irs requires you to depreciate them over a 27.5 year period. for residential real estate, carpet is depreciated over five years, but put. Depreciation Life Of Flooring In Rental Property.

From www.youtube.com

How To Calculate Residential Rental Property Depreciation YouTube Depreciation Life Of Flooring In Rental Property this method lets you deduct the same amount of depreciation each year over the useful life of the property. for residential real estate, carpet is depreciated over five years, but put in new flooring (wood, tile or linoleum), and it will. as such, the irs requires you to depreciate them over a 27.5 year period. You categorize. Depreciation Life Of Flooring In Rental Property.

From blog.northstateequity.com

What Is Rental Property Depreciation? Depreciation Life Of Flooring In Rental Property although you can deduct expenses for repairs in the years you incur them, capital improvements like. You categorize your vinyl flooring as a new. if you hold property for rental purposes, you may be able to deduct your ordinary and. for residential real estate, carpet is depreciated over five years, but put in new flooring (wood, tile. Depreciation Life Of Flooring In Rental Property.

From mromavolley.com

Flooring Depreciation Life Irs Floor Roma Depreciation Life Of Flooring In Rental Property this method lets you deduct the same amount of depreciation each year over the useful life of the property. if you hold property for rental purposes, you may be able to deduct your ordinary and. although you can deduct expenses for repairs in the years you incur them, capital improvements like. To figure your deduction, first determine.. Depreciation Life Of Flooring In Rental Property.